Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

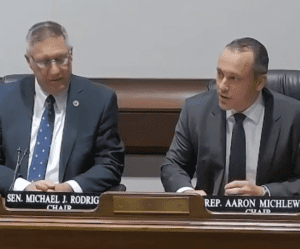

Sen. Michael Rodrigues (left) and Rep. Aaron Michlewitz, chairs of the Senate and House Ways and Means committees, respectively, lead the fiscal 2024 consensus revenue hearing on Jan. 24.

The state’s budget writers announced yesterday that state tax collections are expected to grow by 1.6% in fiscal 2024 over a recently adjusted projection for fiscal 2023 revenue.

Administration and Finance Secretary Matthew Gorzkowicz, Senate Ways and Means Chair Michael Rodrigues and House Ways and Means Chair Aaron Michlewitz announced a consensus state tax revenue forecast of $40.41 billion for the fiscal year that will begin on July 1.

The increase does not include an additional $1 billion in projected revenue from the state’s new surtax on annual incomes over $1 million, which was adopted by voters in November. Dispensing funds generated from the surtax will be subject to appropriation, but the ballot measure stipulated that funds must be spent only in areas of transportation and education. Including the surtax, estimated revenue would increase the total budget projection for fiscal 2024 by 4.1% over the adjusted fiscal 2023 revenue estimate.

The adjusted fiscal 2023 revenue estimate, also announced on Monday by Gorzkowicz, incorporates a $151 million increase based upon year-to-date revenues and economic data, bringing the revised forecast to $39.77 billion. This new estimate for the current fiscal year is $193 million higher than the figure used to create the fiscal 2023 budget that was signed into law in August 2022.

The Healey-Driscoll administration and the House and Senate will use the consensus revenue forecast to build their respective fiscal 2024 budget recommendations.

While it’s good news that state collections are expected to continue growing, it’s unclear what the consensus revenue forecast will mean for local aid accounts. In recent years, under the Baker-Polito administration, the general practice was to link the percentage increase in Unrestricted General Government Aid to the percentage of forecasted growth in state tax collections. Last year, however, in recognition of overwhelming needs in every city and town, the Legislature doubled the percentage increase for UGGA from the 2.7% consensus revenue figure announced in January 2022 to a 5.4% increase. On Jan. 3, the MMA sent a letter to the new administration underscoring the importance of UGGA and asking that they use the revenue estimate that was used in the fiscal 2023 budget law ($39.575 billion) as the base from which to measure the growth relative to the forecast.

The MMA’s recommended calculation shows that the consensus revenue forecast for fiscal 2024 is 2.1% above the base that state leaders originally used to enact fiscal 2023 spending levels last July.

Under state law, the three budget officials convene every year to establish a joint revenue forecast. The estimate must be announced by Jan. 15 in most years, but the deadline is Jan. 31 when there’s a change in administrations. Part of the process is a public hearing — held this year on Jan. 24 — where budget writers hear testimony on the tax revenue outlook from the Department of Revenue, the Office of the State Treasurer, and independent, local economists.

At the hearing, fiscal experts and economists recognized that tax collections far exceeded benchmarks in fiscal 2021 and fiscal 2022, but they offered cautious outlooks for the economy and state revenues over the second half of fiscal 2023 and for fiscal 2024.

Yesterday’s announcement marks a key initial step of the fiscal 2024 state budget process. Gov. Maura Healey is scheduled to file her first budget bill by March 1, and the House and Senate budget plans are customarily released and debated in April and May, respectively.