Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

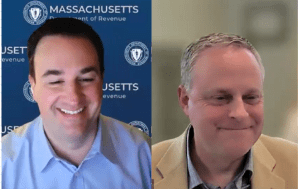

An MMA webinar on April 3 shed light on the responsibilities of the assessor. Speakers included Chris Wilcock, chief of the Division of Local Services’ Bureau Local Assessment, left, and Sherborn Town Administrator Jeremy Marsette.

An MMA webinar on April 3 shed light on the responsibilities of the assessor.

The webinar was led by Chris Wilcock, chief of the Division of Local Services’ Bureau Local Assessment, where he helps municipalities with effective property tax administration.

A former assessor, he opened by defining what assessing is and what it looks like in Massachusetts. He said there are 1,700 assessors in Massachusetts and $1.9 trillion in total assessed value.

Each year, he said, “Assessors must identify all taxable real and personal property, its ownership, its fair market value, and its usage classification as of Jan. 1 in order to assess taxes.”

Wilcock reviewed the mass appraisal process that assessors use to “ensure all properties within a municipality are valued uniformly and equitably.”

He also explained the Fiscal Tax Rate Calendar, which details the tax rate process.

The webinar was intended for municipal managers and mayors who are responsible for overseeing assessing operations, but do not have a background in assessing.

Sherborn Town Administrator Jeremy Marsette moderated 25 minutes of questions and answers, addressing inquiries regarding second home classifications, best practices for forecasting new growth, and tips for how individuals can enter the field.

• Bridging the Knowledge Gap: Key Insights for Overseeing Local Assessing Operations (560K PDF)