Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

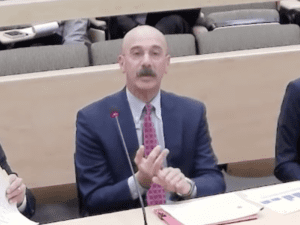

Department of Revenue Commissioner Geoffrey Snyder gives his forecast for the remainder of fiscal 2024 and fiscal 2025 to legislators during the Dec. 4 consensus revenue hearing at the State House.

In light of state tax collections falling slightly below benchmarks for fiscal 2023 — a trend that’s continuing in the first part of fiscal 2024 — fiscal experts concur that the Commonwealth’s fiscal outlook is uncertain for the remainder of the year and for fiscal 2025.

During the annual consensus revenue hearing convened on Dec. 4 by the House and Senate Ways and Means committees and the governor’s budget office, the Department of Revenue and other fiscal experts and economists offered cautious outlooks for the economy and state revenues over the second half of fiscal 2024 and for fiscal 2025.

The Department of Revenue reported that year-to-date collections for the current fiscal year totaled approximately $14.1 billion, which is $146 million, or 1%, higher than collections in the same period of fiscal 2023, but $627 million, or 4.3%, below the year-to-date benchmark.

At the hearing, Department of Revenue Commissioner Geoffrey Snyder said he expects tax revenue growth in fiscal 2025 of between 1.7% and 3.2%. He added that his projection does not include revenue from the state’s so-called millionaires surtax, revenue from which is exceeding expectations. The fiscal 2024 state budget spends $1 billion in anticipated surtax revenue, but those collections are now expected to reach between $1.5 billion and $2 billion for the fiscal year.

The Department of Revenue estimates that fiscal 2025 surtax revenue will be between $1.7 billion and $2.1 billion. Revenue for the surtax — assessed on annual personal incomes above $1 million — must be used to fund public education and public transportation programs.

Additional outlooks for next year presented at the consensus revenue hearing were heavily qualified with discussions of uncertainty due to the ongoing emergency shelter crisis, global conflicts, inflationary pressures, and the fiscal impact of the recently enacted tax relief package, along with the positive outlook for surtax revenue.

The annual revenue hearing marks the start of the state budget season and is important for municipal officials because it provides insights into the direction of the economy and anticipated state revenues available to fund municipal and school aid programs next year, particularly Unrestricted General Government Aid.

Legislative leaders and the administration are expected to reach agreement on a tax revenue forecast for fiscal 2025 in the coming weeks. The forecast will be used in the governor’s budget recommendation, due to be filed by Jan. 24, as well as the House and Senate budget plans that are customarily released in April and May, respectively.