Who is a member?

Our members are the local governments of Massachusetts and their elected and appointed leadership.

The Honorable Aaron Michlewitz, House Chair

The Honorable Michael J. Rodrigues, Senate Chair

The Honorable Ann-Margaret Ferrante, House Vice Chair

The Honorable Cindy F. Friedman, Senate Vice Chair

The Honorable Paul J. Donato, House Assistant Vice Chair

The Honorable Jason M. Lewis, Senate Assistant Vice Chair

The Honorable Todd M. Smola, Ranking House Minority Member

The Honorable Patrick M. O’Connor, Ranking Senate Minority Member

Joint Committee on Ways and Means

State House, Boston

Delivered Electronically

Dear Chair Michlewitz, Chair Rodrigues, and Distinguished Members of the House and Senate Committees on Ways and Means:

On behalf of the cities and towns of the Commonwealth, the Massachusetts Municipal Association very much appreciates your strong support for local government. We look forward to working with you and your colleagues in the House and Senate in developing and finalizing a state spending plan for fiscal 2023 that reflects your continued commitment to a strong state and local government partnership.

In order to build a healthy and sustainable economic recovery in every region of Massachusetts, cities and towns rely on a powerful and supportive state-local relationship. With a tightly capped property tax that limits municipal revenues, cities and towns require predictable and adequate state revenue sharing in order to provide world-class education and municipal services, ensure safe streets and neighborhoods, and maintain local roads and vital infrastructure.

While cities and towns have welcomed much-needed federal relief funding to respond to and recover from the pandemic, municipal leaders recognize that this is one-time funding and can be used only in accordance with the federal guidelines. As such, it cannot be seen as an alternative to state funding and support for local aid and key operational programs.

We are writing today to provide you with information on important funding priorities and investments in key municipal and school aid programs, and ask that you incorporate these requests into the fiscal 2023 state budget bill that you are preparing for House and Senate debate in April and May.

Unrestricted General Government Aid

Cities and towns across the state are asking the Legislature to provide a strong and effective commitment to revenue sharing by increasing Unrestricted General Government Aid (UGGA) by 7.3%, or $85.3 million, to bring the account up to $1.253 billion. This would more adequately reflect the last two years of unprecedented state revenue growth, while acknowledging that future year tax revenues may return to more modest growth patterns.

Unrestricted General Government Aid (UGGA) provides essential funding for vital municipal and school services, allowing communities to deliver core services to residents and businesses, and mitigating further overreliance on the property tax. As you know, discretionary local aid suffered disproportionately large cuts during the Great Recession, and is still nearly $150 million below fiscal 2008 levels, without adjusting for inflation.

UGGA is the only source of discretionary local aid that cities and towns use to fund foundational services for the residents of Massachusetts, including public safety, public health, public works, senior, youth and veterans services, water and sewer services, solid waste disposal and recycling collection, park and recreation services, libraries, and much more. Local aid funding is needed more than ever, as communities are struggling to balance their budgets and maintain these services. Proposition 2½ places a tight cap on property tax revenues, and other municipal receipts are flat, as individuals and local businesses struggle to recover from the pandemic. We are experiencing high inflation and supply chain shortages, and communities are faced with costs that are rising much faster than local revenues.

The bottom line is that this is a very difficult budget year for communities, and cities and towns are depending on the Legislature’s strong commitment to revenue sharing to balance their budgets.

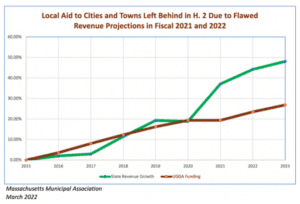

Over the past two fiscal years, the Commonwealth has experienced record growth in tax receipts. In fiscal years 2021 and 2022, state tax collections grew by an estimated $6.54 billion, 22.1% over the amount collected in fiscal 2020. However, during this time, UGGA has received just a 3.5% increase of $39.5 million. It is understandable that the state’s financial success was difficult to predict in the early months of the pandemic, given all of the uncertainty. However, this growing inequity must be addressed as a key budget priority in fiscal 2023. Otherwise, the state will not meet its revenue sharing commitment, and cities and towns will be permanently impaired by a far-too-low discretionary aid funding base. The result will be even greater reliance on capped property taxes, locking communities in a fiscal vise that will continually squeeze out funding for essential municipal and school services in the coming years.

The chart below illustrates that House 2 leaves local aid behind by adopting a flawed – and artificially low – calculation of state tax growth from fiscal 2022 to 2023. The fiscal 2023 consensus revenue estimate is $36.915 billion, set two months ago. The fiscal 2022 state budget adopted by the Legislature last July was based on $34.401 billion in expected state tax revenues, which means that the consensus revenue estimate for fiscal 2023 projects revenue growth of 7.3%. The Governor’s budget artificially undercounts state tax growth by using a much higher revised revenue number for this year of $35.948 billion, instead of the $34.401 billion revenue estimate used to build the fiscal 2022 state budget. This poorly crafted approach creates a far-too-low revenue sharing calculation of 2.7%, leaving cities and towns far behind.

Timing is also essential. Cities and towns are drafting their budgets now and will be adopting them at Town Meetings and city council sessions well before the final state budget is enacted in July. Communities are asking for an early commitment from lawmakers to a full revenue sharing increase so these funds can be planned for and used to maintain core services.

This is a critical time for cities and towns, our residents, and our economy. Every region of the state is facing hardships and challenges. In terms of restoring fiscal stability at the municipal level and ensuring adequate funding for essential local services, the critical first step will be returning to full revenue sharing in fiscal 2023, with a 7.3% increase for Unrestricted General Government Aid.

Chapter 70 School Aid

We support funding for Chapter 70 school aid (7061-0008) that matches the promise of the Student Opportunity Act (SOA). Through the SOA, the state committed to investing an additional $1.5 billion in Chapter 70 education aid, phased in over seven years beginning in fiscal 2021, and reaching its goal in fiscal 2027. The uncertainty surrounding the COVID-19 pandemic initially delayed the first year of funding, and we applaud the Legislature’s leadership in fiscal 2022, delivering a budget to fund the Student Opportunity Act at a rate of one-sixth, rather than one-seventh, in order to remain on schedule.

We support the recommendation in House 2 that funds two-sixths of the Student Opportunity Act schedule, increasing the Chapter 70 account by $485 million. However, 135 of 318 operating districts (42%) would remain “minimum aid” districts, and would receive new aid of only $30 per student. This means that these districts would receive below-inflation aid increases of about 1%, which is simply inadequate to maintain existing programs and services. These 135 districts would receive a combined increase of $9.3 million, and the remaining districts would receive $475 million more.

While school districts have received dedicated federal COVID relief funding, that funding should not be used to replace spending for annual operating expenses. Instead, that funding should be used for one-time expenses to respond to the public health emergency, addressing a wide range of needs, from overhauling HVAC systems to mitigating learning loss through summer enrichment programs.

Each school district will continue to rely on Chapter 70 school aid for existing annual operating expenses. As such, we respectfully request that minimum aid be set so that all districts receive a meaningful increase in fiscal 2023, which we believe should be at least $100 per student. Higher minimum aid is necessary to ensure that no school district or student falls behind.

Charter School Impact Mitigation Payments

As a start, we support funding the charter school impact mitigation account (7061-9010) to reimburse school districts at 90%, the rate set forth in year two of the Student Opportunity Act implementation schedule. Each impacted district should be reimbursed at 90% in accordance with the SOA, and this is reflected in the House 2 recommendation of $219 million.

The sharp increase in assessments levied on local school districts to pay tuition to charter schools has imposed a major financial burden on cities and towns, a problem made more acute as the state grants more charters and existing charter schools expand. Rising charter school assessments are forcing local public schools to cut programs and services to make up the difference.

Because the great majority of K-12 students attend local public schools, this means that the diversion of Chapter 70 funds to charter schools has a directly negative impact on the vast majority of schoolchildren.

Even fully funded, the charter school impact mitigation account is still insufficient to address the deep cuts facing many districts. After receiving mitigation payments, many communities and school districts may still see their charter assessments increase more than their total new Chapter 70 aid. For this reason, we ask that you implement a “circuit breaker” system to prevent any “net negative” situations, so that each community or school district receives a minimum aid increase, after charter payments, based on the number of students remaining in the traditional, non-charter, public school system.

Special Education “Circuit Breaker”

We support full funding for the special education circuit breaker program (7061-0012), through which the state provides a measure of support for services provided to high-cost special education students. This is an essential program that provides critical funding to assist all school districts with the increasingly burdensome and volatile cost of complex and expensive special education services. We ask for full funding of the state’s share of eligible educational costs with the schedule included in the Student Opportunity Act, which added transportation expenses as an eligible cost. H. 2 would provide $414 million for this account. We ask you to confirm the full funding requirement using the most recent data available from DESE, and close any funding gap that may result from an updated analysis.

Student Transportation Reimbursements

Funding to assist cities, towns and school districts with the cost of transporting schoolchildren is another critical priority, and we respectfully urge full funding of the state’s reimbursement obligations.

Regional Schools: We respectfully urge full funding for transportation reimbursements to regional school districts (7035-0006). DESE has estimated that full funding in fiscal 2022 would require $87.4 million, which means the program is actually underfunded by $5.3 million in the current year. Unfortunately, H. 2 proposes to cut the already-too-low appropriation by another $4.3 million, offering just $77.8 million for fiscal 2023. This is clearly less than what will be needed to meet the full funding target. These reimbursements are vital to all regional districts and their member cities and towns, particularly in smaller communities and in more rural parts of the state. We respectfully ask that you increase funding for this key account to reflect higher transportation costs for communities and to move the state to its full reimbursement commitment.

Homeless Students: The State Auditor has ruled that the McKinney-Vento program (7035-0008) is an unfunded mandate on cities and towns. Under the program, municipalities and school districts are providing costly transportation services to bus homeless students to schools outside of the local school district. H. 2 would allocate $22.9 million to this program. We ask you to confirm the full funding requirement using the most recent data available from DESE, and close any funding gap that may exist.

Vocational Schools: In addition, we support funds to reimburse communities for a portion of the cost of transporting students to out-of-district placements in vocational schools (7035-0007), as mandated by state law. This account recognizes the significant expense of providing transportation services for out-of-district placements, as these students must travel long distances to participate in vocational programs that are not offered locally. We respectfully ask that the House and Senate increase this account for fiscal 2023. At just $250,000, it would fund only 5.6% of the estimated $4.5 million expense that communities are facing this year.

Rural School Finance

While the Student Opportunity Act established a special commission to study the long-term fiscal health of rural districts, the special financial and operational challenges facing rural districts were not addressed in the legislation. We support an adequate appropriation to sustain the rural schools assistance program (7061-9813) and question whether the H. 2 level-funded appropriation of $4 million is adequate to meet the needs of rural districts, which have been struggling due to declining enrollments and the economics of operating districts that cannot increase their geographic size. We ask that you increase funding to meet the need.

Payments In Lieu Of Taxes (PILOT)

We support additional funding of the Commonwealth’s obligations and commitments to the program for payments in lieu of taxes for state-owned land (PILOT) (1233-2400). The H. 2 proposal level-funds this account at $35 million. A report completed by the state auditor in December 2020 found that this account has not met the state’s obligation in 20 years, and that the funding for fiscal 2020 should have been $45 million.

This is a particularly important program for the cities and towns that host and provide municipal services to state facilities that are exempt from the local property tax, and we applaud the Legislature’s fiscal 2022 increase, which initiated a path to phasing-in full funding. Unfortunately, H. 2 would stall that progress.

We ask that you make an important investment in this program and continue to phase-in full funding over the next two years, and we also support the auditor’s recommendation to fully fund this account based on the aggregate tax method, and ask that you include a “hold harmless” provision to protect municipalities with reduced land values and PILOT reimbursements.

A Local Aid Resolution To Facilitate Timely Local Budget Decision-Making

Cities, towns and regional school districts need timely notice of the main municipal and school aid accounts in order to prepare and approve forward-looking local revenue and spending plans. We ask that state leaders secure an early agreement on our requested Unrestricted General Government Aid (UGGA) amount for next year, as well as addressing Chapter 70 minimum aid needs.

An agreement would set the stage for a consensus Local Aid Resolution and a commitment to minimum municipal and school aid amounts during March. This would avoid the very difficult budget challenges that occur for regional school districts and member cities and towns when required local contributions are not finalized until mid-July, and would facilitate budget planning during the most uncertain of times.

Summary

This is a critical time for cities, towns and local taxpayers. We know that you and your

colleagues in the House and Senate continue to be outstanding partners for communities across the Commonwealth, and we look forward to working with you on these key municipal priorities. The critical investments highlighted above will ensure a faster and more robust economic and social recovery in every corner of the state.

If you have any questions, please do not hesitate to have your office contact me or MMA Senior Legislative Analyst Jackie Lavender Bird at jlavenderbird@mma.org at any time.

Thank you very much for your support, dedication and commitment to the cities and towns of Massachusetts.

Sincerely,

Geoffrey C. Beckwith

MMA Executive Director & CEO